Nobody likes uncertainty — and, when it comes to your health, uncertainty can leave you vulnerable in times when you need healthcare the most. The ACA’s rough start for people who enroll in Nevada health insurance plans caused the most doubt and confusion early on. Issues with the initial Nevada Health Link website in 2014 resulted in a lot of awkward transition between platforms, the upheaval of data, and subsequent confusion. Many users simply avoided applying for health insurance plans.

This initial confusion is also the reason why Nevada has been one of the worst states for enrollment in the United States. It ranks 6th on a list of states with the highest number of uninsured residents, which, in Nevada, is almost 400,000.

Fast forward a few years, however, and there is now an increasing amount of stability in the way that Nevadans access ACA and non-ACA plans. And that’s good news because health marketplaces can now help more than 77,000 previously uninsured individuals receive subsidized and affordable health care for the first time since the Affordable Care Act first rolled out.

Health Insurance Options for Nevada

You can’t talk about health insurance options in Nevada without understanding the reach and opportunity that the original Affordable Care Act provides for residents of the state. Drawing from the Act, ACA-compliant plans have created exchanges, greatly expanded Medicare benefits, protected consumers with pre-existing conditions, and allowed young adults to remain on their parents’ insurance while they get their footing in the world.

These plans can help cover individual, family, and short term healthcare costs.

1) ACA Health Insurance in Nevada

As with a majority of other states in the U.S., there are four separate levels for Nevada’s ACA health insurance plans. These include the standard Catastrophic, Bronze, Silver, and Gold tiered plans. Some states, like Nevada, also have an “Expanded Bronze” tier, which allows for a more generous level of coverage, on the part of the insurer.

Whereas Bronze coverage will pay for anywhere between 56% to 62% of costs, Expanded Bronze plans will stretch that to a potential 65% of coverage.

Regardless of the metal tier chosen, however, no ACA-compliant plans can charge out-of-pocket maximums over $8,150 and $16,300, as of 2020. Metal coverage levels are absolute, whether plans are sold on- or off-exchange.

Catastrophic

Trade a cheap premium for the highest deductible. However, Catastrophic plans are not available to everyone — you must be under the age of 30 (or be eligible for an exemption)

Bronze

Like Catastrophic plans, Bronze plans have the lowest premiums with higher deductibles. This low-cost coverage works best for relatively healthy people who won’t be paying out-of-pocket medical costs.

Silver

Consider Silver plans the ideal “middle of the way” option, as the premiums are modest, and the deductibles are much more manageable, especially if you’re gainfully employed. Silver plans also offer individuals cost-sharing reductions if your income falls below 250% of the federal poverty level.

Gold

Intended to provide a cushion for those who can legitimately anticipate paying large (and frequent) medical costs, Gold plans have the highest premiums but the lowest deductibles.

Individuals can avail of any of these plans, and ACA-compliant plans offer ways to save money. For example, a single, 30-year-old who doesn’t smoke, and also makes $30,000 per year could be eligible for as much as $102 per month, besides other savings. The average cost savings, thanks to CSRs (cost-sharing reductions) and tax credits for Nevadans, come to around $148 a month.

2) SHOP Health Insurance Plans

If you’re a small business, you may be wondering if you should, or if you can, provide health insurance for your employees. Opting to enroll in Nevada’s Small Business Health Options Program (SHOP) not only attracts better candidates for your company, but it can help your business save big.

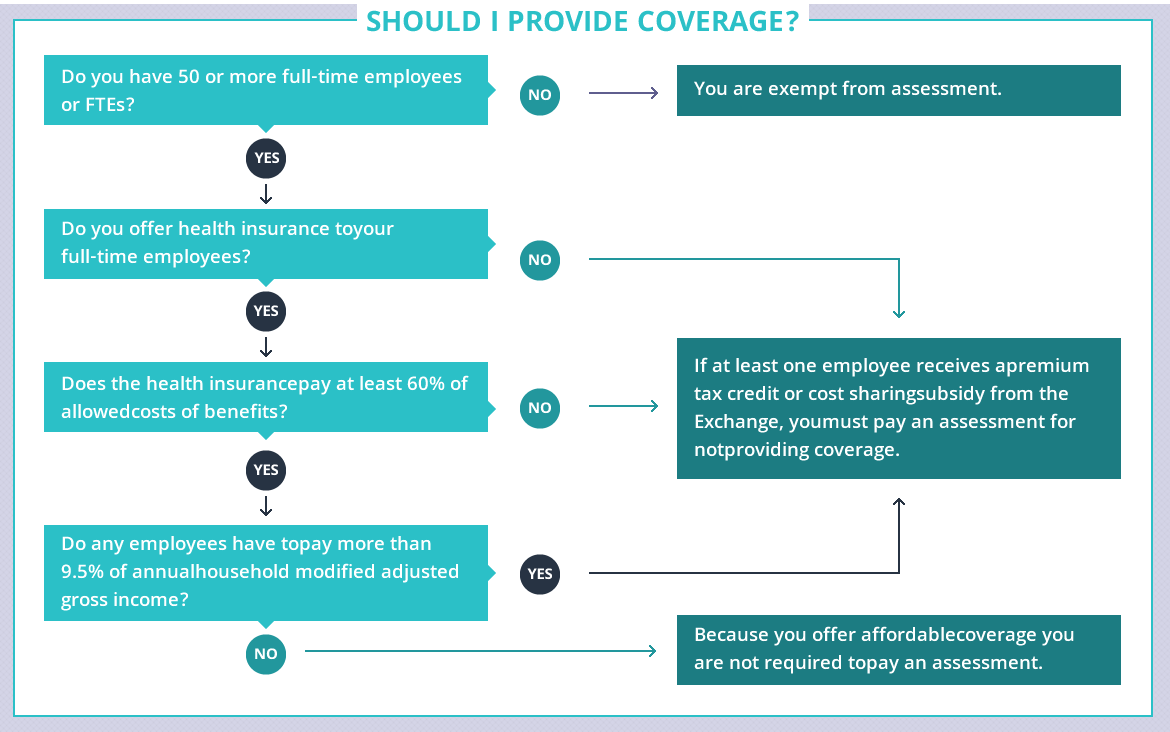

Within certain parameters, you could qualify for the Small Business Health Care Tax Credit. You also don’t have to pay an assessment to the IRS if your business employs fewer than 50 full-time employees.

There are no special enrollment periods for SHOP, and, as an employer, you get to decide on the following factors

- How many options for plans employees have

- Health, dental, or both

- How much you pay towards premiums and whether you offer coverage to dependents

- How long they must wait (or be employed) before enrolling

3) Non-ACA Plans

Non-ACA plans work well for individuals with particular purposes or those in certain situations. They are intended for individuals who need a bridge between their current lack of health insurance coverage in Nevada and, ideally, the next Open Enrollment period. They’re also useful for individuals who are in the country for a short period of time and won’t be receiving other health care coverage through a work or study exchange.

A total of 185 days is the limit for individuals who plan on using temporary health insurance coverage in Nevada. However, unlike many other states that offer short-term health insurance coverage plans, Nevada prohibits any renewal. Even though the present administration has new rules for short-term plans, it’s left up to the state to decide to impose stricter measures.

Nevada only allows individuals to extend their short-term or non-ACA health insurance plans if the insured individual is hospitalized during the date the insurance would typically run out. In this case, the extended policy would cover the remainder of their stay.

How to Purchase Health Insurance in Nevada

Enrolling in a health insurance plan in Nevada runs similarly to other states across the country. If you’re looking for an ACA-compliant plan, you won’t be turned away, and eligibility relies on your residency, employment, and citizenship, not your pre-existing conditions.

Nevadans looking for health insurance will be faced with quite a few options for qualifying health plans and it can be hard to navigate the right plan for you. Simplify the often mysterious and complex process of researching health plans, comparing their advantages, beyond minimum essentials, and submitting the right documents for your application.

Using the Nerdy Insurance Agency, you can gain access to real-time health insurance experts who will walk you through your options for plans in Nevada.

Find the Right Plan Today

If you’re trying to stay within budget while finding the right coverage, then you already know that it can be an overwhelming process. The good news is that Nerdy Insurance Agency can do the work of searching for the right plan for you. Nerdy Insurance Agency is an affordable exchange where you can browse for qualified and non-qualified plans so you can find the right coverage at the right price. Find your new policy today.