In Arizona, the most recent U.S. census estimates that up to 750,000 residents remain without insurance. That’s about 1 in 10 people or 10.6% of the population in 2017. However, improvements to Obamacare and the expansion of Arizona health insurance providers in 2020 mean that there are more choices and stability for Arizonans looking to find the right coverage.

Besides this planned progress, Arizonans can also take advantage of federal subsidies — 84% of residents already qualify, and 48% are eligible for cost-sharing reductions. Depending on the plan and subsidy amount, this means that monthly premiums could decrease to almost nothing.

And even though ACA is still the law, there are now no penalties for being uninsured. Additionally, residents can take advantage of medical assistance or short-term Arizona health insurance plans. This means you have options when it comes to finding the right Arizona health insurance plan for you.

Three Health Insurance Options in Arizona

Even though most employed individuals receive their Arizona state health insurance coverage through employer-sponsored plans, there are a variety of options for residents. Opting for individual health insurance plans — which are essentially ACA/Obamacare plans available through a healthcare marketplace — helped improve Arizona’s uninsured rate.

Furthermore, net enrollment for government assistance from programs like Medicaid/CHIP was up 42% at the end of 2018, which makes health care in Arizona highly affordable and less stressful for household income levels.

ACA Health Plans in Arizona

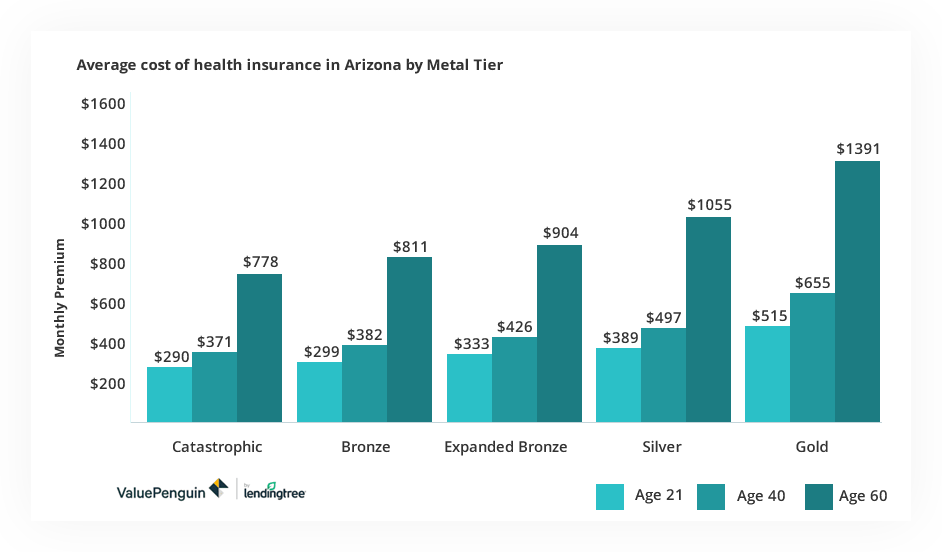

There are more affordable options than ever for individual health insurance in Arizona. In 2020, the average health insurance monthly premium for a Silver plan declined 13% from 2018 to about $497 for a 40-year-old. The variance between age and plan also means that the cost of a Silver metal plan in Arizona may cost someone 60 years of age 112% more than a 40-year-old who chose the same plan.

Health insurance plans in Arizona include five metal tiers:

-

Gold plans

Have the highest premiums in Arizona with lower variable expenses. These plans are, on average, 35% more expensive than Silver plans. Those with high expected medical expenses or the need to fill ongoing prescriptions will find Gold plans most cost-effective.

-

Silver plans

Are designed to be highly affordable, and a kind of middle ground between Gold and Bronze plans. They offer affordable monthly premiums with manageable out-of-pocket costs if and when you need medical care. They’re also the plans eligible for cost-sharing subsidies, so many “low-income” households that don’t qualify for Medicaid can benefit from Silver plans.

-

Expanded Bronze plans

Also known as extended Bronze plans, the coverage values for these plans can go beyond the average maximum and minimum coverage percentages. For example, a company that usually pays 60% of medical costs can offer to cover as low as 56% or as high as 65% of medical costs and include substantial coverage. Premiums remain the same as for Bronze plans.

-

Bronze plans

If you have low medical costs and you’re okay paying, once in a while, for out-of-pocket expenses, Bronze plans will work for you. If you meet with an accident where your bills significantly outweigh the plans’ high deductibles, Bronze will help cover you at a fraction of the monthly cost.

-

Catastrophic plans

Are plans that are structured similar to Bronze plans, in terms of affordability versus high out-of-pocket expenses. However, they’re only available to those below the age of 30.

Am I Eligible for Arizona’s Health Insurance Premium Tax Credit Benefits?

Besides the federal subsidies, there are also two provisions for tax credit benefits issued by the Arizona Department of Revenue. One is a health insurance premium tax credit benefit granted to small businesses who employ no less than two, and up to 25, full-time or part-time employees.

The second is even more beneficial to individuals. The ADOR grants Certificates of Eligibility for health insurance premium tax credit benefits to individual applicants who meet the following criteria:

- Earn less than 250% of the federal poverty level

- Be a legal Arizona resident (and a U.S. citizen or a legal resident alien)

- Not receive coverage by a health insurance policy for at least six months before Certificate application

- Not be enrolled in AHCCCS, Medicaid, or any other government-sponsored health insurance program

| Family Size | Federal Poverty Guideline Gross Yearly Income | Maximum Income to be Eligible for Certificate |

| 1 | $12,140 | $30,349 |

| 2 | $16,460 | $41,149 |

| 3 | $20,780 | $51,949 |

| 4 | $25,100 | $62,749 |

| 5 | $29,420 | $73,549 |

| 6 | $33,740 | $84,349 |

| 7 | $38,060 | $95,149 |

| 8 | $42,380 | $105,949 |

| Over 8, add per child | +$4,320 | +$10,799 |

Under this tax benefit, “family” means an adult and spouse, an adult, spouse, and unmarried dependent children under 19 (or 25, if a student), or an adult and their unmarried dependent children (or 25, if a student).

Non-ACA (Private) Health Plans

With a range of affordable and high-quality options for marketplace health insurance, it’s no surprise that Arizona state would enforce strict regulations for short-term health insurance. Lawmakers and health policy regulators in Arizona require insurance carriers to offer short-term health insurance plans for periods up to 12 months (364 days). Some newer short-term plans in Arizona can also be renewed for up to 36 months without re-applying.

Given that most short-term health insurance plans are meant as a stop-gap to QHPs (qualified health plans), the policy limits dissuade some individuals from relying solely on them. Without essential benefits like maternity, mental health, and pre-existing condition coverage, short-term plans are a workable bridge for those who may have missed the Open Enrollment period.

With a range of affordable and high-quality options for marketplace health insurance, it’s no surprise that Arizona state would enforce strict regulations for short-term health insurance. Lawmakers and health policy regulators in Arizona require insurance carriers to offer short-term health insurance plans for periods up to 12 months (364 days). Some newer short-term plans in Arizona can also be renewed for up to 36 months without re-applying.

Given that most short-term health insurance plans are meant as a stop-gap to QHPs (qualified health plans), the policy limits dissuade some individuals from relying solely on them. Without essential benefits like maternity, mental health, and pre-existing condition coverage, short-term plans are a workable bridge for those who may have missed the Open Enrollment period.

Applying For AHCCCS Health Insurance in Arizona

The third option for Arizona state health insurance coverage is through medical assistance programs.

In Arizona, this is known as AHCCCS or “Arizona Health Care Cost Containment System.” As a Medicaid agency, thousands of Arizonans rely on AHCCCS every year. Doctor’s visits, physicals, immunizations, essential emergency and hospital care, immunizations, prescriptions, and maternity care are all available through AHCCCS for those who qualify.

Under the AHCCCS, residents of the state of Arizona can opt for a variety of different health care plans. Qualifying requirements for AHCCCS include:

-

Income

-

Arizona residency

-

Pregnancy

-

Citizenship and qualified non-citizen status

KidsCare

Arizona’s name of CHIP is the KidsCare program, where qualifying applicants under 18 can take advantage of all the essential medical care services at a fraction of the cost. While there are monthly premiums, KidsCare costs no more than $50 per child or $70 for a multi-child family, regardless of how many children there are.

KidsCare Premium Amounts

| Household Size | Monthly Income Less Than or Equal to 150% FPL | Monthly Income Greater Than 150% But Less Than or Equal to 175% | Monthly Income Greater Than 175% But Less Than or Equal to 200% |

| 1 | $0.00 - $1,595.00 | $1,595.01 - $1,861.00 | $1,861.01 - $2,127.00 |

| 2 | $0.00 - $2,155.00 | $2,155.01 - $2,515.00 | $2,515.01 - $2,874.00 |

| 3 | $0.00 - $2,715.00 | $2,715.01 - $3,168.00 | $3,168.01 - $3,620.00 |

| 4 | $0.00 - $3,275.00 | $3,275.01 - $3,821.00 | $3,821.01 - $4,367.00 |

| 5 | $0.00 - $3,835.00 | $3,835.01 - $4,475.00 | $4,475.01 - $5,114.00 |

| 6 | $0.00 - $4,395.00 | $4,395.01 - $5,128.00 | $5,128.01 - $5,860.00 |

| Each Additional Member* | Add $560.00 | Add $654.00 | Add $747.00 |

| Monthly Premium Amount | One Child $10.00, More Than One Child $15.00 | One Child $40.00, More Than One Child $60.00 | One Child $50.00, More Than One hild $70.00 |

*”Each Additional Member” is an approximate amount only.

What to Do When You’re Ready to Purchase Health Insurance in Arizona

There are different application processes for marketplace health insurance in Arizona and AHCCCS. The latter requires an online application process first to determine if you’re eligible, via the Health-e-Arizona Plus website. Applicants must also show eligibility if they want to renew and need to report any changes such as income levels, marital status, resources like 401ks, or housing expenses.

If you’re enrolling in your state’s health marketplace, however, you have a window of about two months to do so. The Open Enrollment period starts on November 1st and runs through December 15th for coverage beginning on January 1st of the following year. If you’re opting for an individual health insurance plan — which means that you, rather than your employer, are doing all the upfront research and comparison work — you need to have key information on hand.

- SSNs for everyone in the household

- Your employer’s name and address

- A record of your wages or the most recent pay stub

- Information about other forms of income, such as alimony, pension, contract work, etc.

Of course, if you want to eliminate the extensive and often tedious research-and-review process completely, you can opt to use Nerdy Insurance Agency.

At AHiX, we walk you through the series of options for health care through our Arizona health insurance marketplace. You can use our secure hub to learn more about your options for health insurance, compare plans, learn about government subsidies you may qualify for, and then apply for both ACA and non-ACA plans. Our easy enrollment feature helps you assess your options, shop for the right plans and insurers, and then enroll using direct access carrier feeds for pricing and service. Learn more at AHiX or chat with one of our live care specialists today.

Find the Right Plan Today

If you’re trying to stay within budget while finding the right coverage, then you already know that it can be an overwhelming process. The good news is that AHiX can do the work of searching for the right plan for you. Nerdy Insurance Agency is an affordable exchange where you can browse for qualified and non-qualified plans so you can find the right coverage at the right price. Find your new policy today.